Depreciation scrap value formula

S scrap value. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

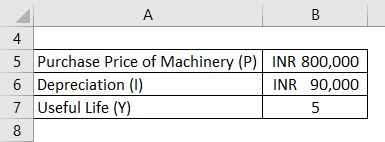

Depreciation Formula Calculate Depreciation Expense

Here we discuss how to calculate Depreciation Expenses along with practical examples and downloadable excel template.

. Annual depreciation is 13500. Residual value is the estimated value of a fixed asset at the end of its useful economic life. The individual components known as scrap are worth something if they can be.

In this instance while Car A is the more expensive car its annual depreciation is lower because it has a higher OMV which translates into a higher ARF and thus a higher scrap valuePARF rebate. Calculate the WDV Rates. Purchase price - salvage value.

C cost of an asset. Determine the initial cost of the asset at the time of purchasing. Sum of Year Depreciation Example.

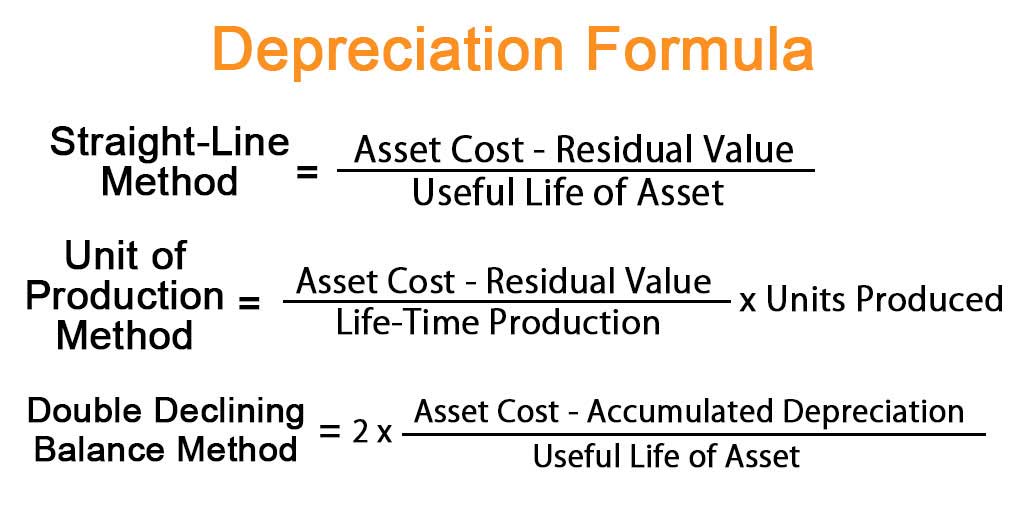

No doubt different cars depreciate at different rates according to the rule of thumb it is better to assume. Lets understand the same with the help of examples. Here we can use the above formula and accordingly.

Declining Balance Method Example. Guide to Depreciation Expenses Formula. Thus depreciation rate during the useful life of vehicles would be 20 per year.

For example if a companys machinery has a 5-year life and is only valued 5000 at the end of that time the salvage value is 5000. Depreciation value per year. We then invest this amount in Government securities along with the interest earned on.

What is a Salvage Value Scrap value. Estimate the assets lifespan which is how long you think the asset will be useful for. Find this value by estimating the total value of an assist if you expected to resell retire or scrap it.

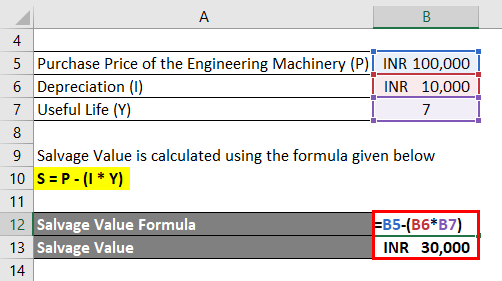

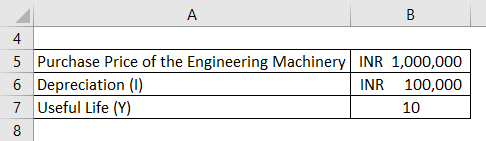

The value of particular machinery any manufacturing machine engineering machine vehicles etc after its effective life of usage is known as Salvage value. Salvage Value Formula Calculator. Under this method we transfer the amount of depreciation every year to the sinking fund Ac.

1useful life of asset 10. The years of use in the accumulated depreciation formula represent the total expected lifespan of an asset. Let us consider the asset 10000 with a useful life of 5 years and no residual value Residual Value Residual value is the estimated scrap value of an asset at the end of its lease or useful life also known as the salvage value.

Scrap value is the worth of a physical assets individual components when the asset itself is deemed no longer usable. The average value for mid-size cars range between 150 300. The same formula is used to calculate the scrap value of an asset whichever method of depreciation is used SLMWDV Scrap Value 100000 6125795 3874205 The above examples should make it easy for anyone aspiring to learn how to calculate the scrap value of an asset especially with the help of some examples.

For example if the machinery of a company has a life of 5 years and at the end of 5 years its value is only 5000 then 5000 is the salvage value. It represents the amount of value. Read more ie the value.

The asset experiences a total depreciation value of 938 each month of its useful lifespan. The formula goes like this. The depreciation expense for a 500000 machine that is expected to have a value of 100000 in five.

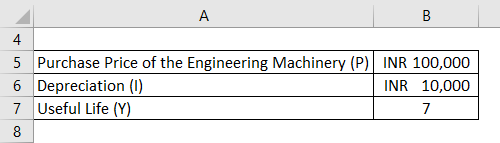

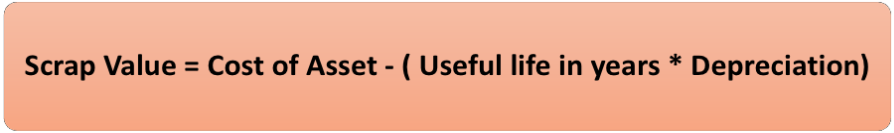

Depreciation Value per year Cost of furniture Salvage value Useful life. Scrap Value Cost of Asset - Useful life in years Depreciation Formula for Scrap Value. It represents the amount of value the owner will obtain or expect to get eventually when the asset is disposed.

Illustration 1 Suppose a Plant is purchased for 10 lakhs and its estimated useful life is 10 yearsThe scrap value at the end of the useful life is estimated to be 25 lakhs. NBV is calculated using the assets original cost how much it cost to acquire the asset with the depreciation depletion or amortization of the asset being subtracted from the assets original cost. Insurance companies however will use the following formula to calculate scrap value.

Depreciation Cost of asset Residual Value x Annuity factor. Scrap car prices are usually calculated by the weight of the vehicle. The following is the formula.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. To determine attributable depreciation the company assumes an asset life and scrap value. Depreciation on Income.

Net book value NBV refers to the historical value of a companys assets or how the assets are recorded by the accountant. With an enormous number of manufacturing organizations depending on their machinery for supporting efficiency they consistently assess the gear they own. Youll be left with the depreciation value of your furniture per year.

First subtract the salvage value of your furniture from the cost of the furniture when it was new. Use this calculator to calculate an accelerated depreciation of an asset for a specified period. In other words when depreciation during the effective life of the machine is deducted from Cost of machinery we get the Salvage.

Determine the salvage value of the asset Salvage Value Of The Asset Salvage value or scrap value is the estimated value of an asset after its useful life is over. Say for example a business purchases equipment for 10000 which it estimates will be in use for 10 years at which point the scrap value will be 4000 the residual value in accounting will be 4000. Steady use and different variables cause a constant disintegration.

Annual Depreciation Expense Cost of an asset Salvage ValueUseful life of an asset. A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the Double Declining Balance MethodUse this calculator for example for depreciation rates entered as 15 for 150 175 for 175 2 for 200 3 for 300 etc. Depreciation per year Asset Cost - Salvage Value.

Estimate the salvage value or how much the asset will be worth when its no longer useful. Get 247 customer support help when you place a homework help service order with us. Sinking fund or Depreciation fund Method.

A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. Tanks have a useful life of 10 years and a scrap value of 11000-. Salvage value or Scrap Value is the estimated value of an asset after its useful life is over and therefore cannot be used for its original purpose.

In regards to depreciation salvage value sometimes called residual or scrap value is the estimated worth of an asset at the end of its useful life. Thus The formula as per the straight-line method. Meanwhile the scrap value of smaller vehicles can be as low as 100.

Find the amount of Depreciation per Year by calculating depreciable costassets lifespan. After useful lives of an asset how much reduction has happened in a fixed asset is called salvage value or breakup value or scrap value or residual value. Car B costs 145000 with a scrap valuePARF value rebate of 10000 after ten years.

What is the normal depreciation rate for cars. Scrap Value Cost of Asset - Useful life in years. Then divide it by the useful life of the furniture.

Straight Line Depreciation Formula. If the salvage value of an asset is known such as the amount it can be sold as for parts at the. Ram purchased a Machinery costing 11000 with a useful life of 10 years and a residual value Residual Value Residual value is the estimated scrap value of an asset at the end of its lease or useful life also known as the salvage value.

Not Book Value Scrap value Depreciation rate.

Salvage Value Accounting Formula And Example Calculation Excel Template

Salvage Value Formula Calculator Excel Template

Scrap Value Definition Formula And Examples

How To Calculate Book Value 13 Steps With Pictures Wikihow

How To Calculate Depreciation Expense

Salvage Value Formula Calculator Excel Template

How To Use The Excel Ddb Function Exceljet

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

A Complete Guide To Residual Value

Depreciation Calculation

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Depreciation Rate Formula Examples How To Calculate